by crvanwyk | May 23, 2023 | Tax

INSIGHTS – NEWS NamRA to scrutinize zero tax returns The Namibia Revenue Agency (NamRA) has noticed that several businesses continuously submit zero-tax returns, essentially indicating that no profits were recorded for the relevant tax years. Home » Archives for...

by crvanwyk | Mar 3, 2023 | Tax

INSIGHTS – NEWS Budget Speech 2023/2024 On 22 February 2023, Finance and Public Enterprises Minister Iipumbu Shiimi, delivered the 2023/24 Budget Speech in Parliament. Home » Archives for crvanwyk Budget Speech 2023/2024 On 22 February 2023, Finance and Public...

by crvanwyk | Feb 7, 2023 | Tax

INSIGHTS – NEWS Tax Amendments 2022 The following amendments to the income tax and VAT Act were published in December 2022. Act No. 13 of 2022, which amends the Income Tax Act, Act 24 of 1981.Act No. 14 of 2022, which amends the Value-Added Tax Act, Act 10 of...

by crvanwyk | May 31, 2022 | Tax

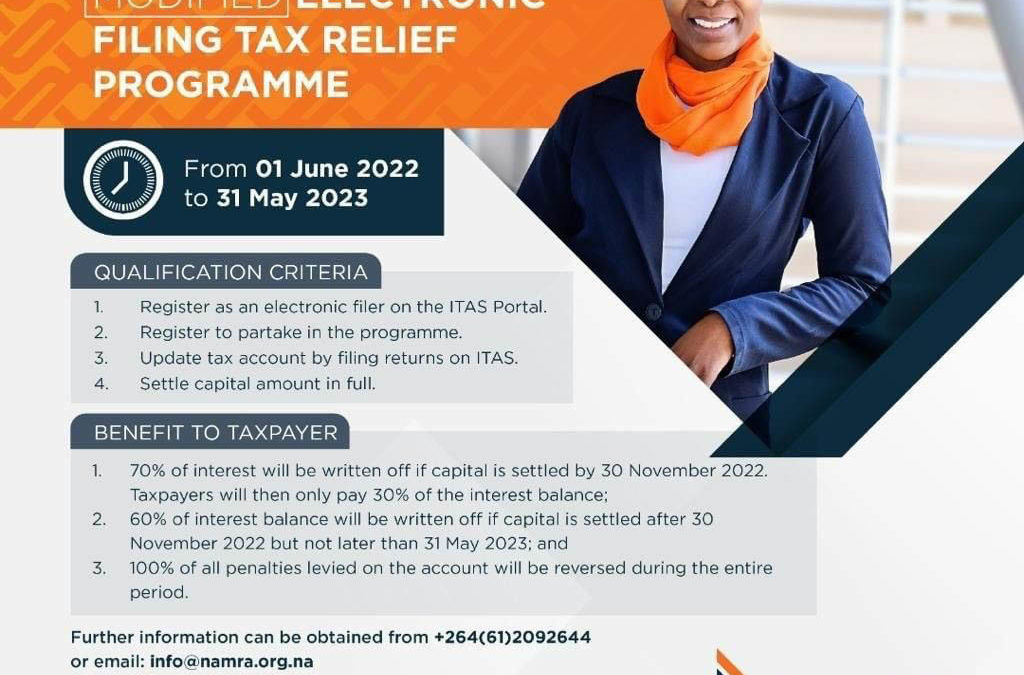

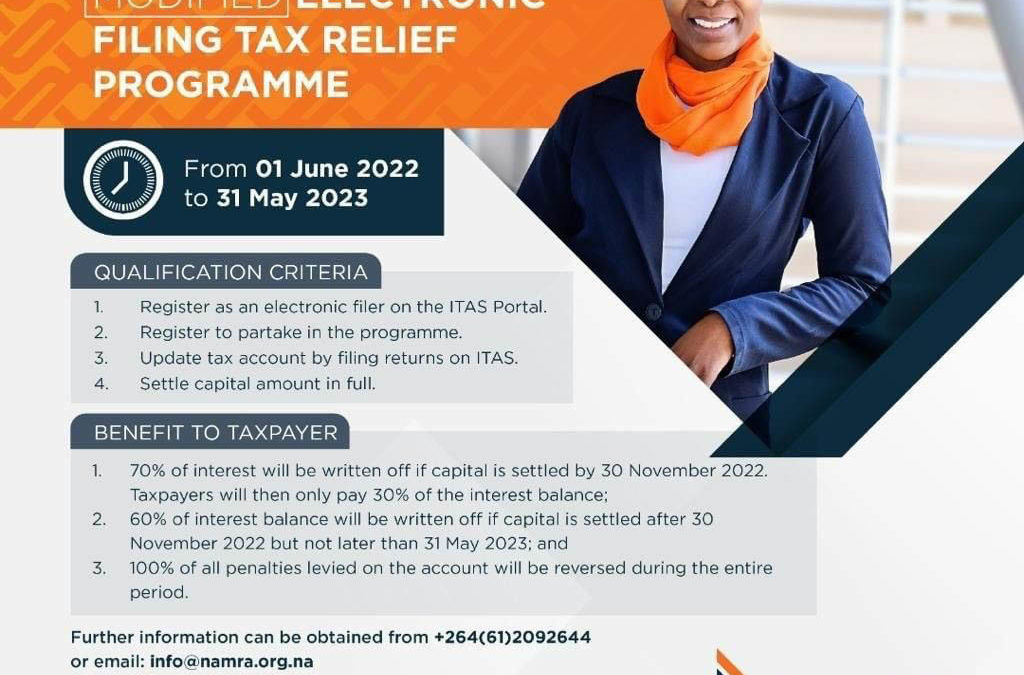

INSIGHTS – NEWS Modified Electronic Filing Tax Relief Programme Introducing the Modified Electronic Filing Tax Relief Programme. From 01 June 2022 to 31 May 2023. Home » Archives for crvanwyk Related News Search for: Further Reading NamRA to scrutinize zero tax...

by crvanwyk | Mar 7, 2022 | Tax

INSIGHTS – NEWS Namibian Budget 2022/23 On 24 February 2022, Finance Minister Iipumbu Shiimi tabled the 2022/23 Budget Speech in Parliament. There are no significant tax amendments, and no changes were announced on the individual tax rates. Home » Archives for...

by crvanwyk | Sep 22, 2021 | Tax

INSIGHTS – NEWS Directive No 3 Of 2021 To The Master Of The High Court The Master of the High Court has been directed to de-registered trusts who are in non-compliance with the Financial Intelligence Act (FIA) 2012. Home » Tax Non-compliance with the...